StockOrbit’s AI Performace

For the week of Nov 6th – 10th, StockOrbits AI had a gain of roughly 40,000 dollars, about a 5.55% overall portfolio gain from the previous week.

A total of 8 trades were taken, with 1 loss and 7 wins.

Members who were subscribed get access to this custom algorithm directly into the StockOrbit app. If interested, subscribe here and contact me at support@stockorbit.app.

Last Weeks Data

Not much happened economically in regards to Department of Labor reports.

Michigan Consumer Sentiment Survey

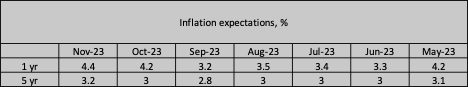

On Friday we had the University of Michigan Consumer Sentiment Survey reporting at around 10 am Eastern time. The University of Michigan Consumer Research Center conducts a telephone survey of about 500 consumers. Consumers are asked questions about personal finances, business conditions, and buying conditions. The Consensus was 63.7, however, the number came out at around 60.4. Big miss! Most importantly the numbers for inflation, which the report takes into account, measured inflation to be 4.4%, a number that increased month over month.

We have inflation increasing for both the 1 year and 5 year for 3 months back to back. The Fed will be closely monitoring these numbers as well as CPI and PPI coming out this week.

I have been a big bull in regard to higher interest rates due to inflation being sticky. The data that has been coming out for weeks has been supporting this thesis, regardless of what the markets do. We can sell off 6% in one day, it’s just a matter of time… I am going to be watching CPI and PPI very closely and what those numbers mean next week. We know that the consumer is going to be spending their money this quarter due to holidays. We know that this is the biggest quarter for a lot of big tech, especially Apple. I am very interested in what the Fed will due in December. I am expecting more rate increases.

30-Year Bond Auction

Last Thursday, at 1 pm EST, we had the US Government 30-year bond auction. There are three things that we care about. The high yield, when issued yield, and the bid to cover(BTC) ratio. The bond market is the biggest market in the entire world. The bond market is what drives the equities market, commodities, FOREX, everything. Anyway back to the data. The high yield for the 30-year bond was bid at around 4.769%. The US Government accepted about 23.9 billion dollars, paying out a coupon of 4.769% to the bondholders. Now, the when-issued yield is held before the public auction to banks/hedge funds/foreign governments, etc. The when-issued yield is what the markets expect to bid during the auction. The when-issued yield came in at about 4.69%, but the actual yield was 4.7%. About 30 basis points move between what the market expected to bid, and the actual bid. Going to the bid to cover ratio, the ratio shows how much demand there is for US government bonds. The BTC came in at around 2.24, which is starting to enter the lower band of liquidity levels for the bond markets.

This is a big deal. The Bond market is what drives everything. Clearly, the market agrees. We had a big sell-off starting at 1 pm from that crappy bond auction.

We saw the market sell-off for about 50 points in ES futures. There is starting to be a liquidity problem in US bonds. It is clear that investors are not interested in the low yields that the Government is offering. Why would they want higher yields? For what reason? Interest rates are determined by two factors. One is inflation, and the other is the risk of default. So investors are either thinking that the US will default on their debt, OR inflation will be increasing. The US Government will never default on its debt, they will just print more money to prevent that. However, something that they can’t control very easily, is inflation. So big-time investors, are expecting inflation to continue higher, which results in them wanting a higher yield for their money. This is a clear red flag for the Federal Reserve, and quite frankly anyone who follows the bond markets and interest rates, that interest rates are going to go higher, for longer. I have been a big bull in the treasury yields for months, and I just got the first confirmation that the big-time investors are seeing the same thing as I am.

Just look at that big spike in the 10-year yield. I am expecting the 10-year yield to break far above 5% and head towards 6%, resulting in the USD soaring, and equities puking. It will be very interesting to see how the next bond auction will do. A break of the BTC below 2, is going to get really ugly for both the Federal Reserve and the US Government. The Fed will have to decide between keeping the US government funded or handling inflation.

Moody’s Economic Downgrade

After hours on Friday, Moody downgraded the US Government’s economic outlook, citing higher interest rates, and the government’s ability to grow with such high interest and high debt. This is not a downgrade of the US government’s credit rating. Moody’s is one of the last creditable credit agencies still holding an AAA credit rating for the US government. Moody has never downgraded the US government credit rating in recent years. The last time Moody’s changed the U.S. government’s credit rating outlook to negative was on June 2, 2011. During the next couple of weeks, the market puked about 300 points from 1330 to 1075, which is a 20% dump. A downgrade from Moody for the US government’s credit to AA would be disastrous.

We all knew this was coming. The US Government is spending far more than it’s taking in from taxes and other revenues. With the higher interest rates that the government is now being forced to pay to fund the government through bonds and T Notes/Bills, the deficit is running even higher. Coming into the politics happening in Washington, it seems they can’t even agree on one simple thing. The US government will have to pass another funding bill, to keep the government open and allow them to pay their coupon payments to bondholders. IF they fail to do this, I would not be surprised if the market pukes, in two weeks. We are in crazy times and don’t get caught holding the bag. I have no faith in Washington getting anything meaningful done.

This Upcoming Weeks Reports

Coming in on Monday, 2 pm EST, we have the Treasury budget report. The Treasury budget is a monthly account of the surplus or deficit of the U.S. government. Detailed information is provided on receipts and outlays of the federal government. Moody will be looking at this number very closely to see how much the government is spending as compared to how much they are taking in.

Tuesday at 8:30 am EST we have the Consumer Price Index (CPI)!! The consumer price index is a measure of the average change over time in the prices paid by consumers for a fixed market basket of consumer goods and services. The CPI provides a way for consumers to compare what the market basket of goods and services costs this month with what the same market basket cost a month or a year ago. Expecting Core CPI to increase, which excludes food and energy. Expect yields to surge and equities to fall.

We saw in July CPI bottom, at around 3%. The latest number for CPI for the month of September was 3.69%. If my theory of inflation being sticky is correct, I expect CPI to be at or above 3.69%. This is a HUGE red flag for the Fed if this number comes in very hot!!!

Wednesday at 8:30 am EST, we have the Producer Price Index (PPI). The producer price index is a family of measurements tracking changes in selling prices received by domestic producers. The PPI follows price changes for nearly every goods-producing industry in the domestic economy, including agriculture, electricity and natural gas, forestry, fisheries, manufacturing, and mining.

In conjunction with Core CPI, I am expecting PPI to come in higher than September.

Just with CPI, we see in the PPI chart above, a bottom in July 2023, where it’s starting to take a U-Turn to the upside. If this number does come in hot, along with CPI, equities will plummet, and the 10-year yield will be back above 5%.

Overall Market Update

Over the last two weeks, we saw a massive buy-the-dip rally, due to Janet Yellen offering a buyback program for US Bonds. This provides investors with liquidity to use in the markets as needed. However, that liquidity is now gone. We are at a big turning point in the markets. Either we rally hard into the end of the year, or we reverse and puke. With all the economic data that I have beeen reading over the last several weeks, I am a bear. I do not think we get the end-of-year rally. BUT, I have my own algorithms that trade on a separate account, where I do not touch what they do. Regardless of what the markets will due, I have gotten my alpha from my algorithms that run on the side, which is available to everyone.

You can see we are near that swing high of 4430 on ES. My prediction is we break 4430, head higher to around 4450ish and we reverse lower downwards to 4000. We have a ton of reports coming out this week for inflation numbers and with the Moody’s report of downgrade, this week will be vital to set the trend for the rest of the year. Remember from the last newsletter we had three important levels. 4332, 4200, and 4400. We are near 4400 and a close above that is vital to continue the bull run. A break below 4322 we sell down to 4200 and then 4000.

Coming into the NAAIM index, The NAAIM Exposure Index represents the average exposure to US Equity markets.

We clearly see most of the funds have covered their shorts and either went flat or have long. There is no more risk of a short squeeze. This gives me further confidence that the market is at risk of falling and trapping all those longs.

We are at a pivotal time right now. A downgrade of US credit by Moody’s will plummet this market. The last time Moody’s downgraded the US economic outlook, the market sold by 20% in 2011. Important inflation reports are coming out this week and will set the trend for the rest of the year.

My Plans for This Week

I will be traveling again, so I will be planning a morning call in my discord at 7 am EST on Monday to go over this newsletter post, and Friday as a wrapup for the week. Join the free discord and listen in to my talks. https://discord.gg/c58chAN5dw

About Me

Thanks for reading my posts. My name is Chris and I am a Software Engineer with a bachelor’s and master’s in Computer Science, with an MBA in Finance(about one more semester left). I have beeen involved in the financial markets for over 6 years now, writing my own algorithms that trade for me, and provide me with signals to act on. I am also currently serving in the Army National Guard as a captain. I love the markets and I love helping people. I am a big New York Giants fan.